Google’s new multi-billion dollar market: Hollywood entertainment

Back in April, the Wall Street Journal reported that Google was spending a hundred million dollars to commission premium YouTube content from the likes of Creative Artists Agency, William Morris Endeavor and International Creative Management, to name a few. But the search monster’s agenda is likely much, much bigger, per research note issued to clients by William Blair & Company. The research firm believes that “Google is silently buying/licensing hundreds of millions of dollars of professional Hollywood content”. Think $100-$200 million for rights to premium Hollywood content:

Google has the resources and infrastructure to be a big player in Hollywood content. Becoming a major player in the premium-content industry requires a com- bination of capital and technology resources that few have. Google fits the bill, how- ever, with $39 billion in cash, annual free cash flow of $9.4 billion, Android, Chrome, YouTube, Google TV, the world’s largest advertising platform, and Motorola Mobility’s set-top-box business. Lastly, Google has made several key Hollywood hires over the past year to understand content rights.

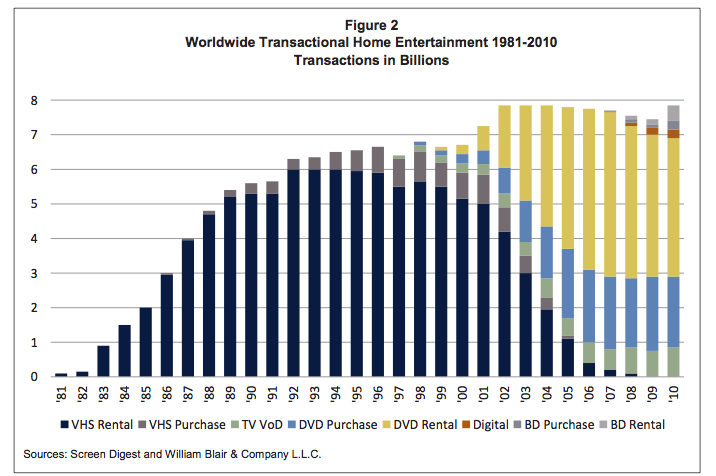

Hollywood studios could consider going to bed with Google should it subsidize their wholesale fees and at least partially monetize the movies through advertising. Consumers would be given the choice of either watching a pricier, ad-free version or rent ad-supported titles for a lower fee. Stakes are high in this game. The market is worth an estimated $65 billion and just advertising on digital home entertainment is a billion dollar business (see the table after the break).

Google, of course, is facing fierce competition from the likes of Apple, Amazon, Netflix, Hulu, in addition to traditional retailers such as Best Buy (CinemaNow) and Wal-Mart (Vudu). Weighing in on Amazon, Google and Apple, William Blair summed it up nicely:

We believe Amazon’s digital agenda is to gain Prime customers, Apple’s strategy is to sell devices, and Google’s focus is to build a bigger ad footprint.

Now, if Google has in fact been quietly licensing studio content left and right, prudent watchers should expect a splashy announcement alongside GoogleTV 2.0, which is due end of summer, as in any day now. If Google can leverage their pending Motorola acquisition, which makes millions of set-top boxes for other IPTV players, Google could quickly establish an end-to-end Hollywood entertainment delivery platform that even Apple might find difficult to crack. In all, Google has likely found its new $65 billion market, the research note reasons: