comScore: iOS and Android continue move toward duopoly with 90 of US market in November

According to the latest numbers from comScore MobiLens for the United States mobile phone market, Apple and Samsung both continue to gain marketshare as the leading OEMs as Android and iOS move closer toward a duopoly with a combined almost 90 percent of the market. ComScore’s latest numbers track the three-month period ending in November, which saw Apple jump from 17.1-percent in August to 18.5-percent of the U.S. mobile phone market. Samsung continued its lead jumping up 1.2-percent to 26.9-percent, while gains for both companies come at the expense of decreases in market share for LG, Motorola, and HTC.

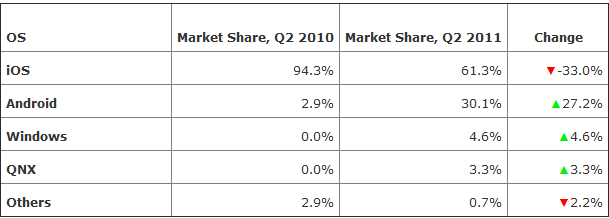

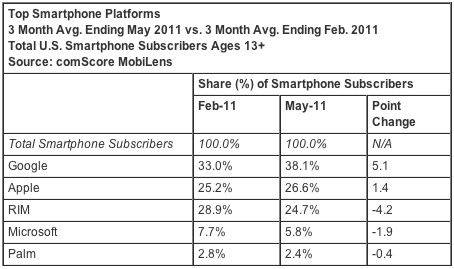

As for the U.S. market by platform, iOS and Android both experience slight gains over August numbers. With a joint 88.7-percent of the market for Apple and Google, RIM is the closest competitor dropping from 8.3-percent of the market in August to just 7.3-percent in November. Microsoft dropped from 3.6-percent to 3 percent:

As for the U.S. market by platform, iOS and Android both experience slight gains over August numbers. With a joint 88.7-percent of the market for Apple and Google, RIM is the closest competitor dropping from 8.3-percent of the market in August to just 7.3-percent in November. Microsoft dropped from 3.6-percent to 3 percent:

In November, 75.9 percent of U.S. mobile subscribers used text messaging on their mobile device (up 0.3 percentage points). Downloaded applications were used by 54.2 percent of subscribers (up 0.8 percentage points), while browsers were used by 52.1 percent (up 0.1 percentage points). Accessing of social networking sites or blogs increased 0.9 percentage points to 39.2 percent of mobile subscribers. Game-playing was done by 33.7 percent of the mobile audience, while 28.7 percent listened to music on their phones (up 0.4 percentage points).