As scammers continue to find new ways to extract money from innocent people, it’s more important than ever to protect your family members (and even yourself) from having too much personal info available online.

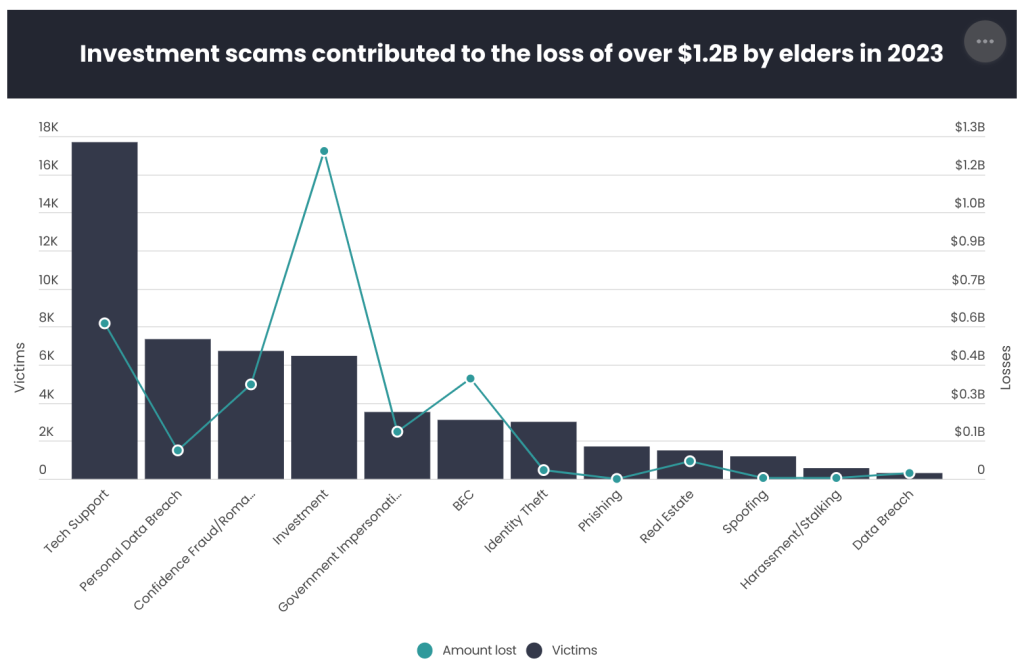

Across the United States, scammers are taking advantage of our parents and loved ones’ lack of familiarity with technology. According to research data provided by the FBI and analyzed by Incogni, tens of thousands of people over the age of 60 lost a combined total of $3.4 billion to fraud in 2023 alone. Worse, this criminal industry is on the rise, with over 10% more reports filed last year than in 2022.

The data show that the most common form of online scam for this group is to impersonate tech support. This often happens through an unexpected call, text message, or email claiming that one of their devices has a virus that needs to be removed immediately. Instead, these attackers are given full access to a computer or phone to access sensitive files, potentially including financial details. Tech support fraud can be more believable if the scammer seems to already know exactly what devices your loved one is using (a trick made easy thanks to data brokers).

Another type of scam that’s seen significant growth involves the attacker building a relationship with their target. Under the guise of romance, the fraudster may ask for money or fish for personal details that may help with security questions. Alternatively, they may pretend to be both a friend and a financial advisor. Once trust has been built, this “friend” will recommend putting money into a fake cryptocurrency platform, but when your loved one tries to withdraw money, it won’t be possible.

- Get 55% off an Incogni annual plan by using code “9to5google” at checkout.

Common forms of data-enabled fraud:

- Investment

- Tech support

- BEC

- Confidence fraud/romance

- Government impersonation

- Personal data breach

- Real estate

- Identity theft

- Data breach

- Spoofing

- Harassment/stalking

- Phishing

These are just a few of the 12 common types of fraud that Incogni’s researchers have identified as becoming much more harmful and costly when a person’s private information is available online. The more information that can be learned about someone ahead of one of these scams, the more likely it is to succeed. When they do succeed, the consequences can be devastating: “In 2023, the average amount lost per victim was $33,900.”

How Incogni can protect your family from scammers

The question, then, is how can we prevent our loved ones from falling victim to one of these schemes?

For starters, technology companies are well aware of these schemes and are introducing new ways to address them. Case in point, Google’s Pixel phones can automatically block all calls that are likely to be spam or fraudulent, and more recently, the company demoed AI-powered real-time alerts about potential scams.

However, while convenient, these solutions are still quite a long way from fully protecting our parents and loved ones from online scammers. Instead, the best current way to defend against these schemes is to keep private information from getting into malicious hands, making it harder to build fake trust. This is where our friends at Incogni come to the rescue.

Data brokers of all varieties, such as people search sites, collect and hoard details about everyone they possibly can and sell that information to anyone willing to buy. This can include names, contact info, interests, and associated people – more than enough details to make a scam seem trustworthy.

For years now, Incogni has fought to keep your personal information private and off the internet. With an Incogni subscription, the company will repeatedly contact over 170 data brokers on your behalf to ensure that your details are never for sale. It’s the closest thing we have to a “silver bullet” to stop fraudsters in their tracks.

To help you get started, Incogni is offering an exclusive deal for 9to5Google readers, bringing the cost of its annual plans down by 55% – just use code “9to5google” at checkout. Better yet, the service comes with a 30-day money-back guarantee, so there’s no risk in trying it out.

Given how damaging online fraud can be, it only makes sense to protect our family members (and ourselves) from becoming targets. Incogni can do the hard work for you, and this exclusive discount is one you won’t want to miss.

Header image: Incogni

FTC: We use income earning auto affiliate links. More.

Comments