In the US, the biggest banks already work together on Zelle money transfers, and now they’re planning a digital wallet to compete with the likes of Apple, PayPal, and Google.

According to the Wall Street Journal, this “new product that will allow shoppers to pay at merchants’ online checkout with a wallet that will be linked to their debit and credit cards.” There’s no name/branding yet, with other details possibly changing before the planned second half of 2023 launch.

U.S. consumers who are up-to-date on payments, have used their card online in recent years and have provided an email address and phone number will be eligible.

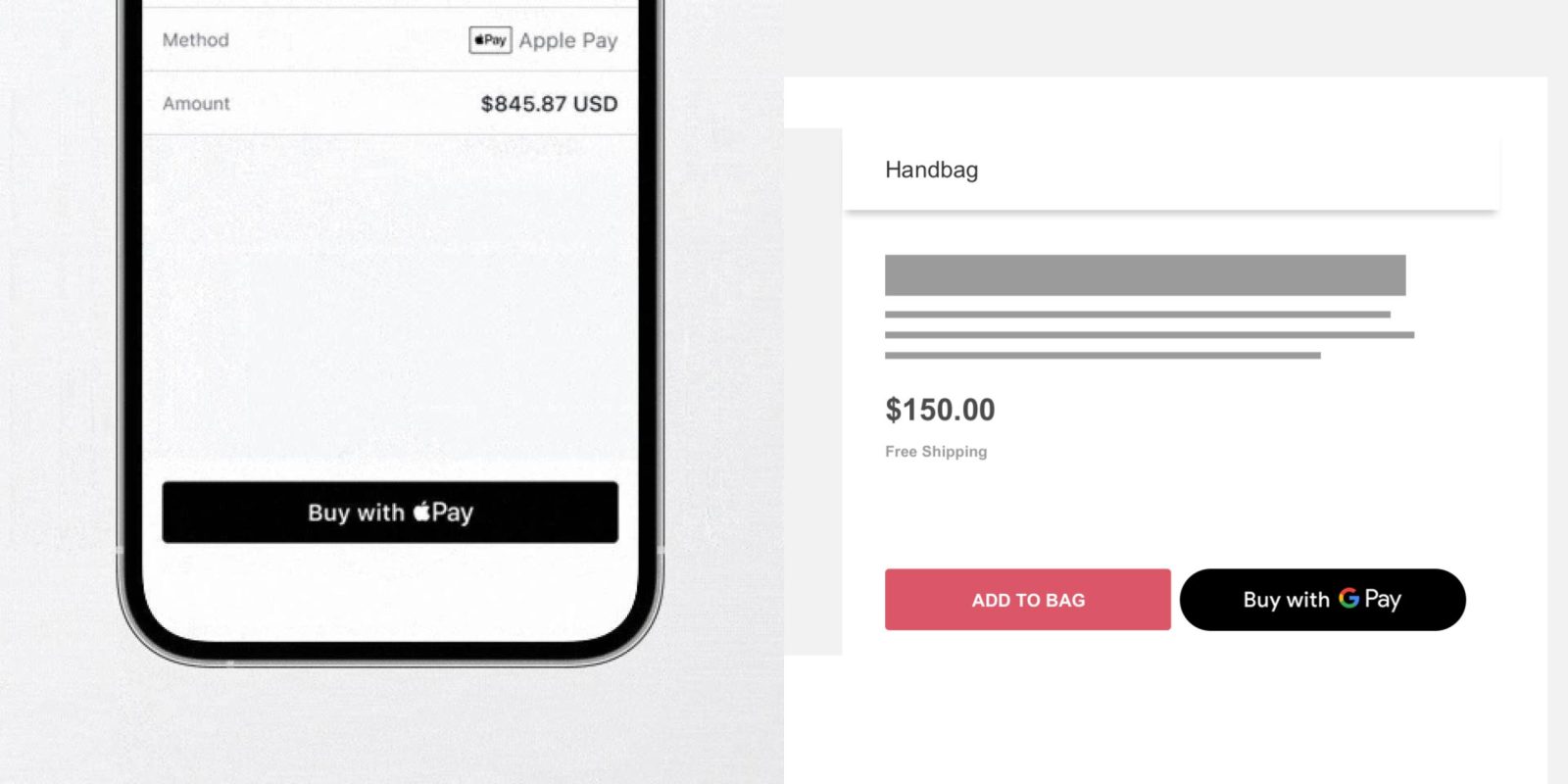

In terms of the end user experience, it might involve typing in your email address on a checkout page, with the merchant then checking with this new digital wallet to “identify which of the consumer’s cards can be loaded.” You then select one for the transaction and won’t have to enter your card number, which can help reduce fraud.

In terms of logistics, this will be operated by the same joint venture (Early Warning Services LLC) that’s behind Zelle today, though it will be independent of the transfer service.

EWS is owned by Bank of America, Capital One, JPMorgan Chase, PNC, Truist Financial, U.S. Bank, Wells Fargo, with WSJ reporting that “the banks expect to enable 150 million debit and credit cards for use within the wallet when it rolls out.” Visa and Mastercard will be supported at launch.

The goal of this is to combat Apple Pay and PayPal, banks reportedly “worried about losing control of their customer relationships.” Google Pay/Wallet is not mentioned in the WSJ article, but Google does compete in that area.

- Apple Pay Later lets you pay in installments, directly in Wallet app, inc 0% interest

- Apple Card integrating new savings account feature for Daily Cash

FTC: We use income earning auto affiliate links. More.

Comments