As announced in February, “GPay” is no longer available in the US. The redesigned Google Pay was announced in 2020 to “make money simple, secure, and helpful” with plans for a “mobile-first bank account” that never came to fruition.

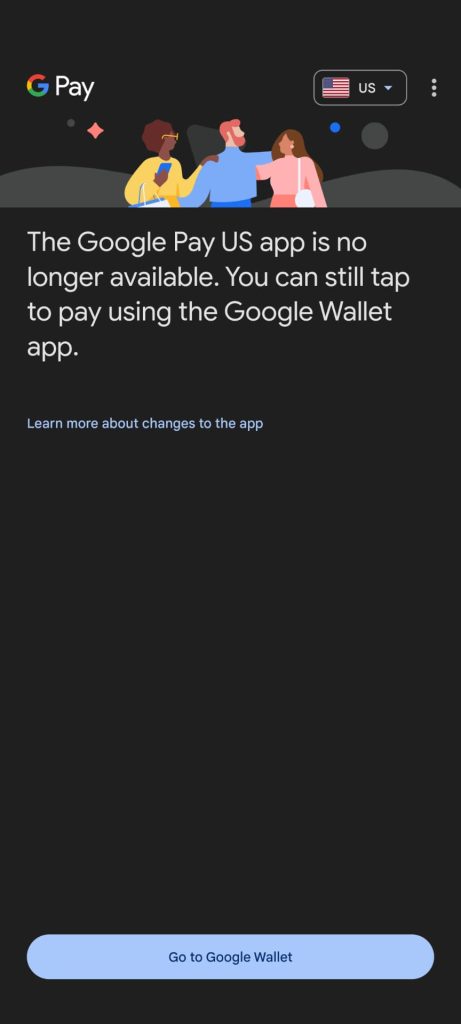

Starting on June 4, GPay — as was the name of the app on Android homescreens — automatically signed US users out. Attempting to login again explains how: “The Google Pay US app is no longer available. You can still tap to pay using the Google Wallet app.”

Additionally, Google no longer offers peer-to-peer payments in the US. You can use the Google Pay website to view and transfer your balance — money you’ve received or rewards— to a bank account after June.

The focus is now on Google Wallet and digitizing everything in your physical wallet. There’s no equivalent finance tracking functionality. Meanwhile, “Google Pay” still exists as the name for what you’re actually using when making a physical or online purchase with your phone.

The main premise of the big redesign was an app centered “around your relationships with people and businesses” with message-like conversations serving as a purchase history. You could also keep track of your bank account and credit card (via Plaid) in the “Insights” tab, while a lot of deals and cash back offers were presented.

At the November 2022 announcement, co-branded checking and saving “Plex Accounts” were also previewed. Google partnered with banks and credit unions, most notably Citi. There would have been a physical card

Savings and the ability to create customizable goals was the other big tentpole. You could create specific tasks with milestones to break things up. One option would have been to “round-up transfers” on all purchases to help meet the goal.

Plex was supposed to launch in 2021, but Google announced that October how the project was canceled. This was despite a waitlist of 400,000 people. Officially, Google was shifting to “delivering digital enablement for banks and other financial services providers rather than us serving as the provider of these services.”

FTC: We use income earning auto affiliate links. More.

Comments