For the first time in MediaTek’s history, the Taiwanese firm surpassed Qualcomm in terms of sales of devices utilizing their chipsets in Q3 2020.

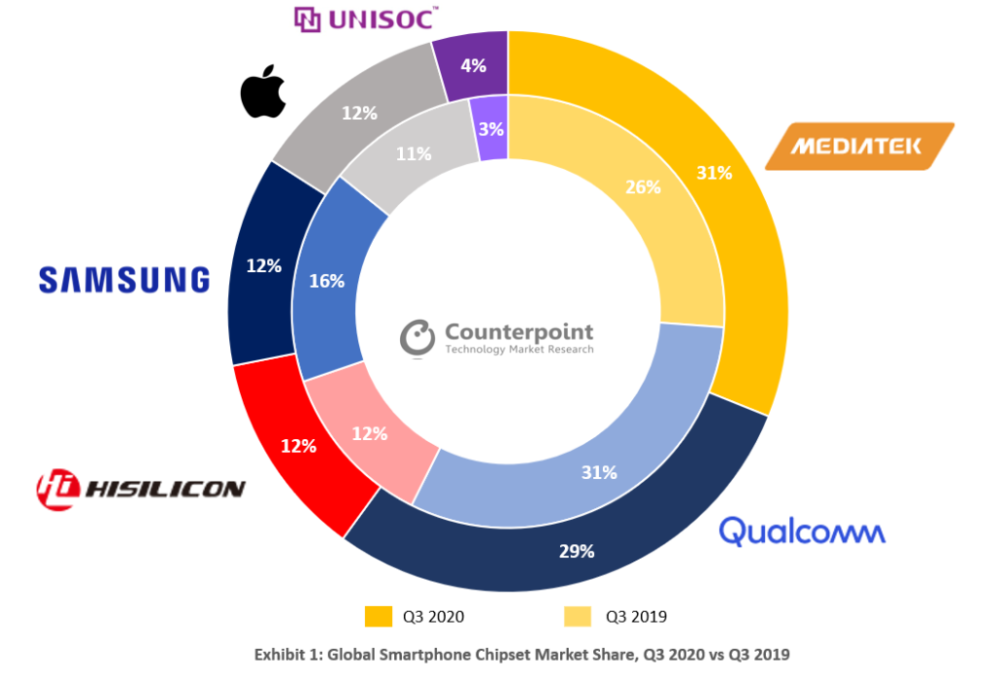

As we have seen a very different approach from many OEMs throughout 2020, the rise of the mid-range has meant the adoption of MediaTek chipsets in yet more devices. A report by Counterpoint Research now claims that Qualcomm lost market share, with MediaTek taking 31% of the entire chipset market in Q3 2020. That accounts for a proposed 5% growth in sales year-on-year for the firm often playing catch-up with the defacto market leader Qualcomm.

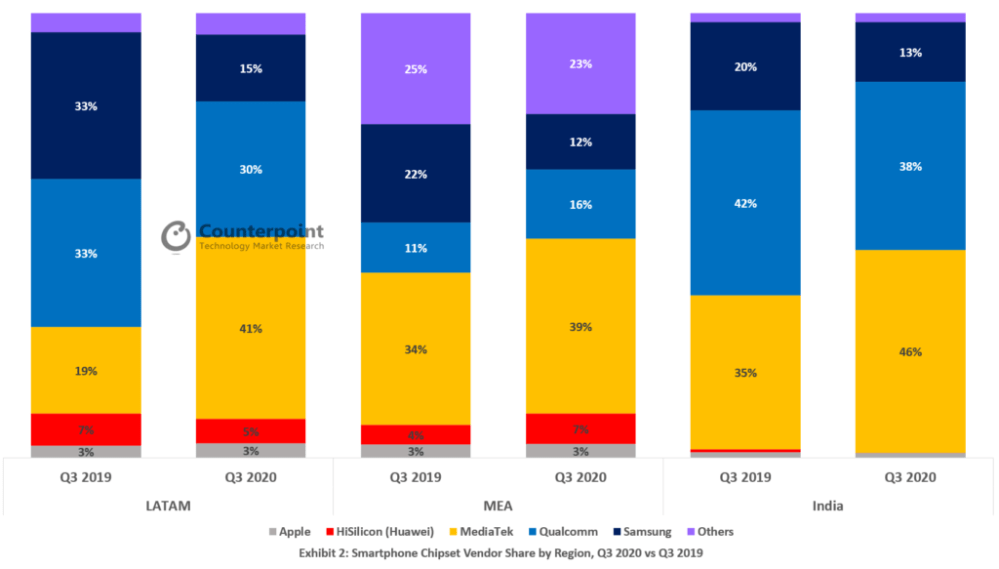

Counterpoint points to the strong performance of smartphones within the $100-$250 price range in China and India — which often utilize MediaTek chips — as the driving force behind this recent growth. As we have mentioned, the growth of the affordable Android segment and the economic effects of COVID-19 across the globe will no doubt have played a part in this shift.

However, while MediaTek boasts the accolade of being the biggest chipset vendor in Q3 2020, Qualcomm reigns supreme as the “premium” champion. The firm tightened its stranglehold over the fledgling 5G smartphone market, as around 39% of all 5G-powered devices contain a Qualcomm chip. However, of the millions of smartphones sold throughout Q3 2020, only 17% were 5G capable.

Meanwhile, Qualcomm was the biggest 5G chipset vendor in Q3 2020. It powered 39% of the 5G phones sold worldwide. The demand for 5G smartphones doubled in Q3 2020 – 17% of all smartphones sold in Q3 2020 were 5G. This impressive growth trajectory is going to continue, more so with Apple launching its 5G line-up. One-third of all smartphones shipped in Q4 2020 are expected to be 5G enabled. There is still a chance Qualcomm will regain the top position in Q4 2020.

While MediaTek celebrates, it’s surprising that Huawei’s HiSilicon was able to retain a 12% overall market share given the turmoil that has surrounded the Chinese firm over the past 18-24 months. Huawei’s shrinking share within the “premium” smartphone segment outside of China is likely one of the catalysts for Qualcomm’s recent growth within that space.

Another notable point is that the recent release of 5G-enabled iPhone 12 series will no doubt have a major effect on these market share figures throughout the latter portion of 2020 and into 2021. MediaTek may continue to grow in a similar vein though, as their own affordable 5G-capable chipset lines bleed into the next wave of budget devices throughout the same time period.

More on Android:

- Best Android app deals of the day: Baldurs Gate II, Twilight Pro Unlock, Passpartout, more

- Xiaomi Mi 11 is the first Snapdragon 888 smartphone, ships w/ Android 11, no charger

- Android’s Fast Pair UI for setting up headphones updated to look like iOS

FTC: We use income earning auto affiliate links. More.

Comments