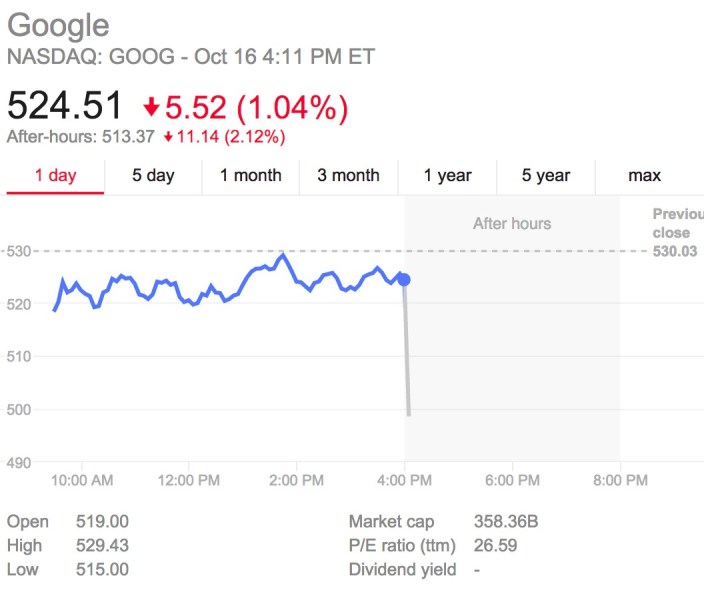

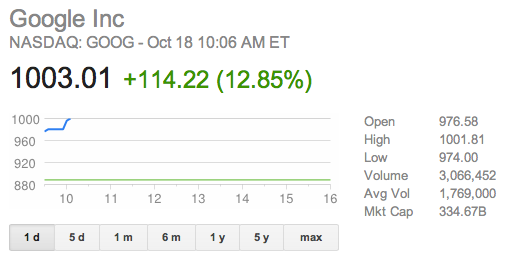

More than three years after Google founders Larry Page and Sergey Brin first proposed it, a controversial stock split has finally been scheduled for 2nd April after a shareholder lawsuit opposing the move was settled. The split will see the number of shares doubled and their value halved.

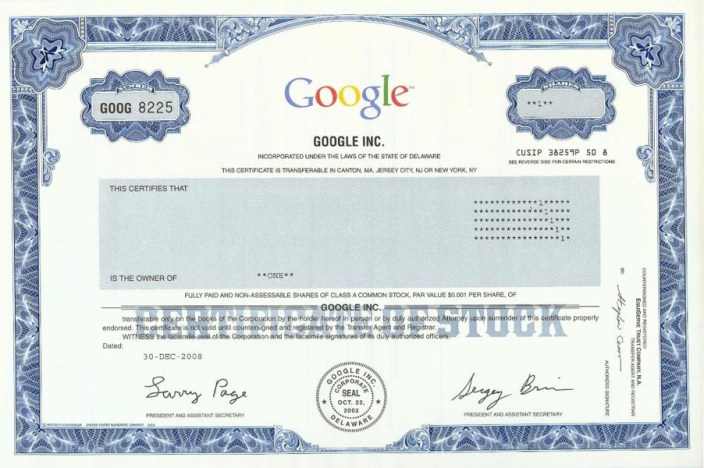

The controversy stemmed from the form the new shares will take. Google currently has two types of stock: Class A and Class B. Class A stock is what most shareholders own, and gives them normal voting rights. Class B stock, held by Page and Brin, gives them ten times the voting rights per share, which gives them 56 percent of the voting rights despite owning only 15 percent of the company.

The stock split will create a third type of share, Class C, which have no voting rights. This will enable the company to issue additional shares to reward employees without Page and Brin losing control of the company. Existing shareholders will get one Class C share for each Class A share they own. The lawsuit alleged that Class C shares would trade for less, and that their existing shareholding would therefore be reduced in value.

Under the terms of the settlement, Google has effectively agreed to make good any losses as a result of a gap opening up between the values of A and C shares, with up to $7.5 billion set aside. Class C shares will trade under Google’s existing ticker code GOOG, while Class A shares will get a new code, GOOGL.

Via Mercury News